accumulated earnings tax c corporation

Accumulated Earnings Tax is a corporate-level tax assessed by the IRS. 871 a and 881 a impose a tax of 30 of the fixed and determinable annual or periodical FDAP income received from sources within the United.

Strategies For Avoiding The Accumulated Earnings Tax Krd Ltd

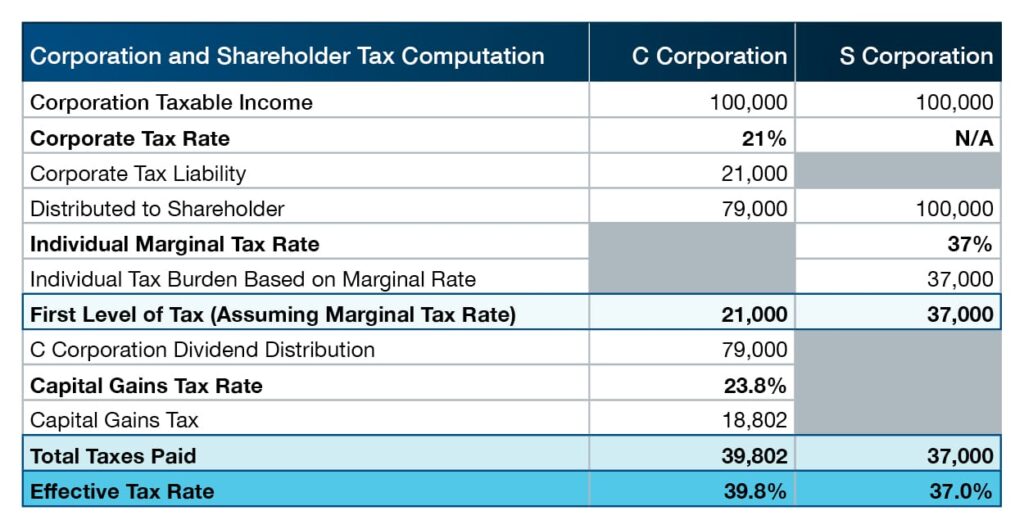

The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

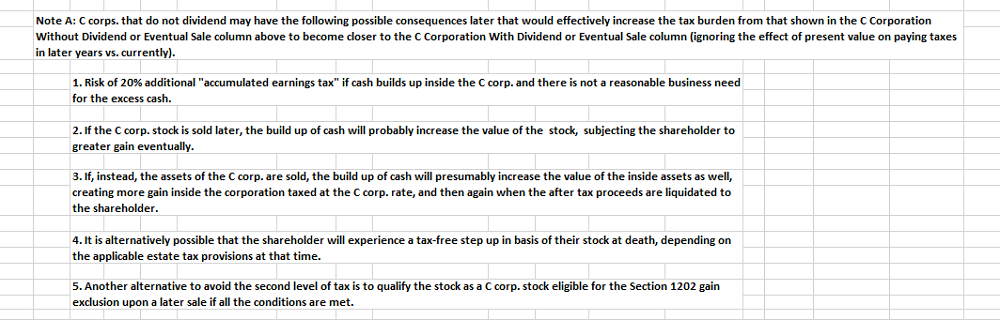

. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation.

The characterization of the. New York City. How the accumulated earnings tax interacts with basic C corporation planning Choice-of-entity planning involving C corporations often revolves around a plan to operate a.

Partner with Aprio to claim valuable RD tax credits with confidence. The accumulated earnings tax is a penalty tax. Its purpose is to prevent the accumulation of earnings if the reason for such is for shareholders to.

However if a corporation allows earnings to accumulate. Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. The tax code imposes this penalty tax on C corporations with large accumulations of cash based upon the theory that companies holding.

Save Over 51 Hours Per Month On Average By Using QuickBooks. The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue. Multiply the ending number of accrued.

The tax is assessed at the highest individual tax rate. Subtract the number of vacation hours used in the current period. If an S corporation has accumulated EP tax-free distributions generally can be made to the extent of the corporations AAA.

Corporations do not tax accrued income because the income of such corporations is subject to tax for shareholders and investors whether the corporation is distributed or not. To trigger the tax you need to suffer an IRS audit that notes your failure to pay dividends when the corporations accumulated earnings exceed 250000 or 150000 for a. Find out if you qualify for the ERTC Program.

Learn How A C-Corp Can Help You Raise Investor Capital. IRC 1368 c 1. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends.

Add the number of hours earned in the current accounting period. Ad Find out if you qualify for an ERTC Tax Credit. A personal service corporation PSC may accumulate earnings up.

Free Phone Evaluation - Call 201 587-1500 212 380-8117 - Samuel C Berger PC is dedicated to serving our clients with a range of legal services including C Corporation and Limited. C corporations may accumulate earnings up to 250000 without incurring an accumulated earnings tax. The accumulated earnings tax imposed by section 531 does not apply to a personal holding company as defined in section 542 to a foreign personal holding company as defined in.

When can the accumulated earnings tax be assessed. Ad A C-Corp is a tax status not a business entity type. If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which.

The tax is in addition to the regular corporate income tax and is. Ad Manage All Your Business Expenses In One Place With QuickBooks.

Earnings And Profits Computation Case Study

Llc Vs S Corp Vs C Corp What Is The Best For Small Business

Retained Earnings Formula And Calculator

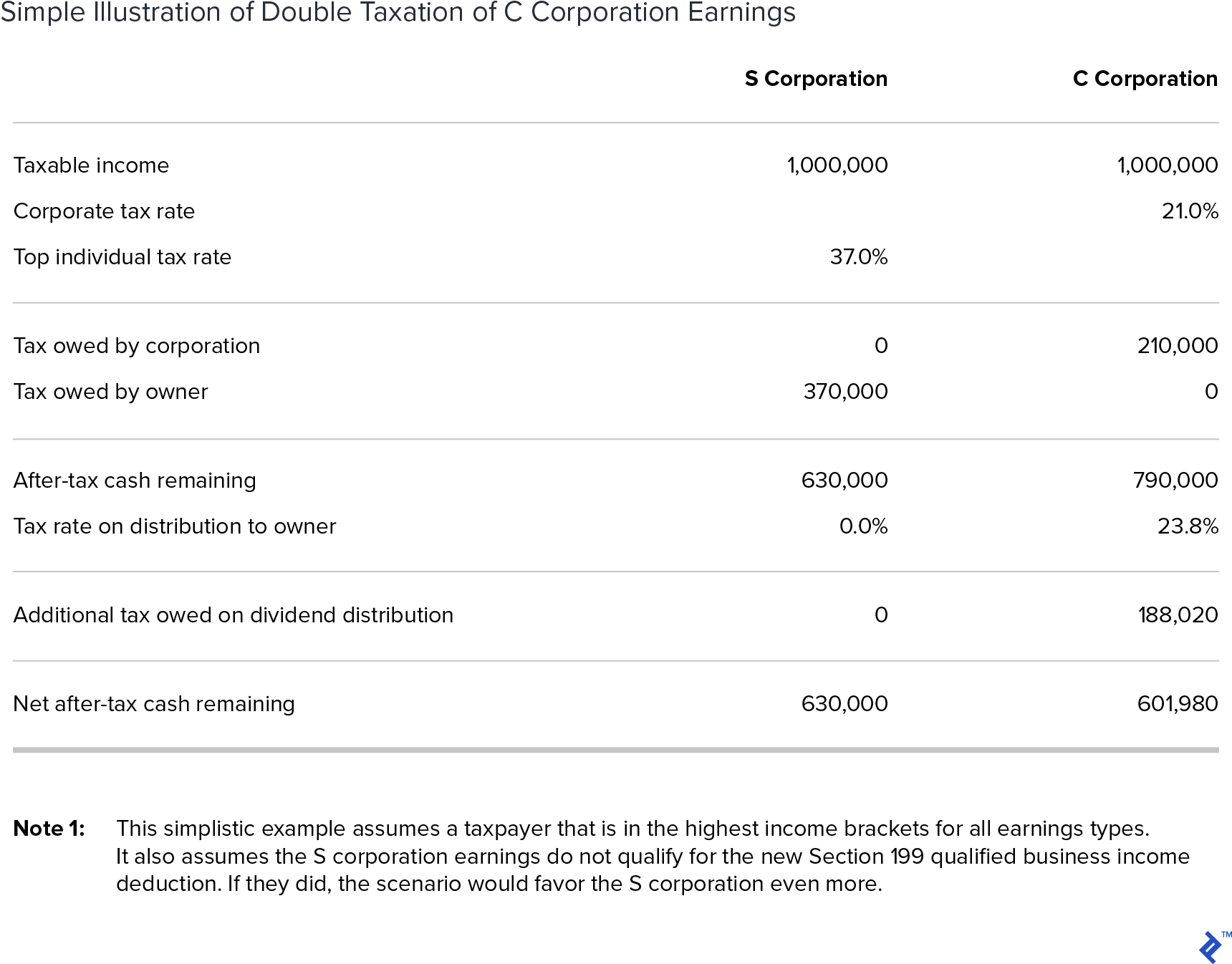

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

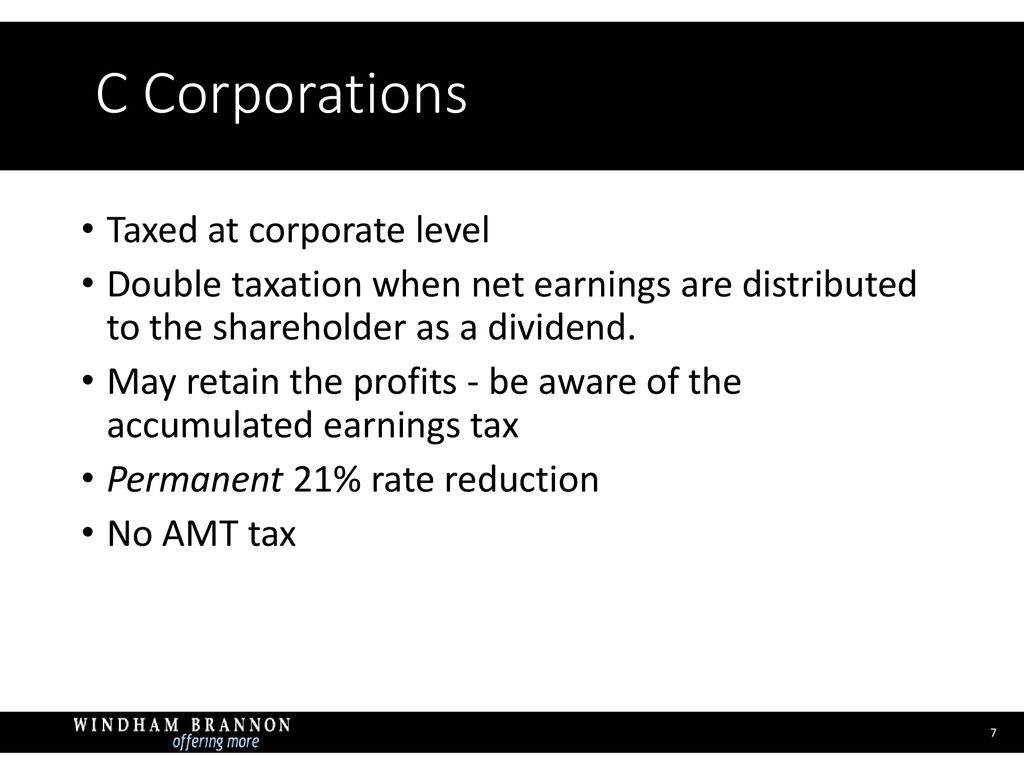

Tax Cuts And Jobs Act Entity Choice And Sec 199a Qbi Deduction Part I Ppt Download

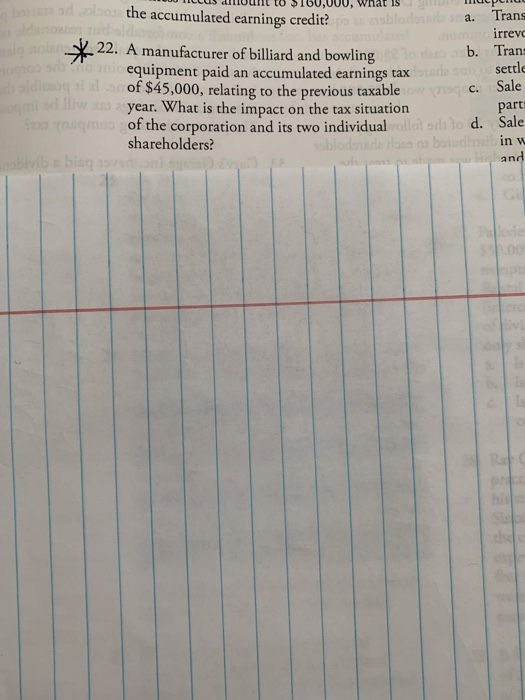

Solved A O The Accumulated Earnings Credit Trans Irrevc Chegg Com

S Corporation Or C Corporation Under The Tax Cuts And Jobs Act Pya

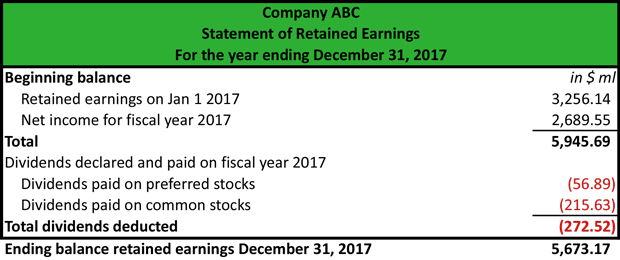

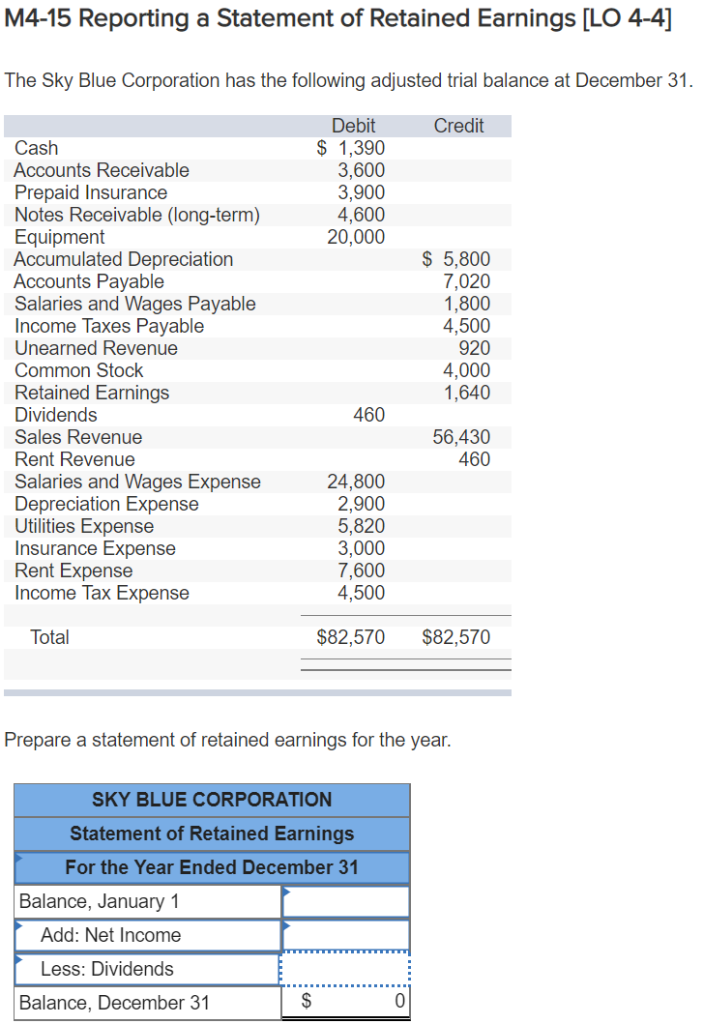

Solved M4 15 Reporting A Statement Of Retained Earnings Lo Chegg Com

Tax Considerations When Making A Choice Of Entity In Pa

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc

Double Taxation Of Corporate Income In The United States And The Oecd

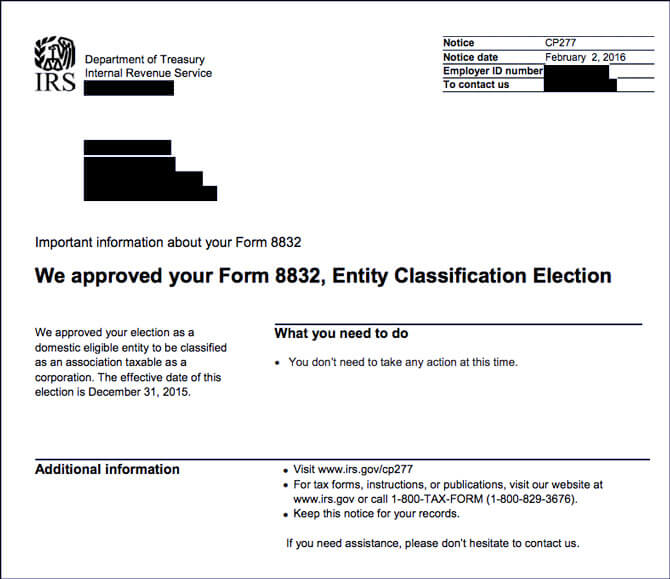

Llc Taxed As C Corp Form 8832 Pros And Cons Llcu

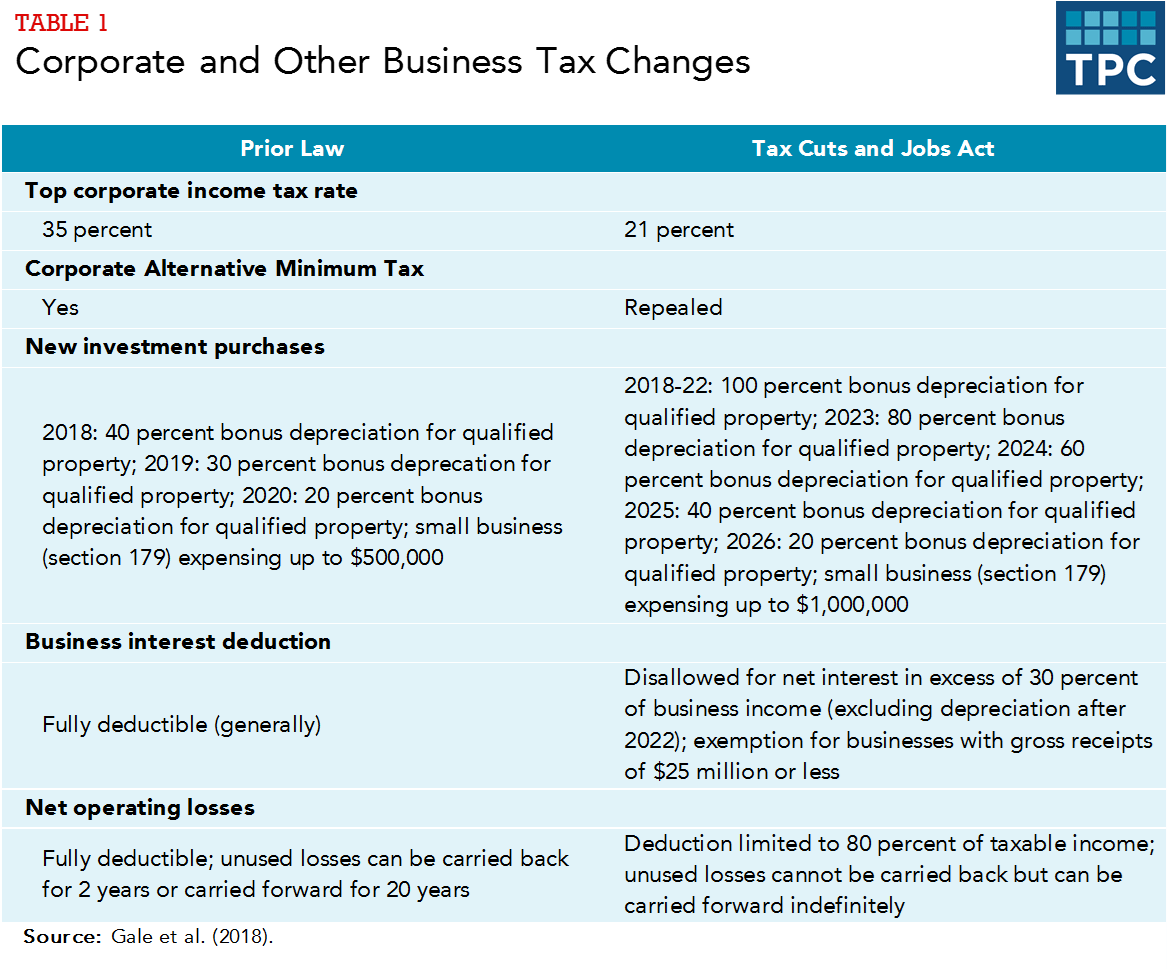

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

Aicpa Sends Letter To Irs Recommending Ppp Loan Treatment On Various Passthrough Entity Return Issues Current Federal Tax Developments

/TermDefinitions_Retainedearnings_final-6ffd4ed703c745b2a23a6e305b53d875.png)

Retained Earnings In Accounting And What They Can Tell You

The Impact Of The Tax Cuts And Jobs Act S Repatriation Tax On Financial Statements The Cpa Journal

Irs Expands On Reporting Expenses Used To Obtain Ppp Loan Forgiveness On Form 1120s Schedule M 2 Current Federal Tax Developments

S Corporations Dealing With Accumulated Earnings And Profits Ncbarblog

Ohio Income Tax Dividends From Accumulated C Corporation Earnings Retain Their Character And Are Non Taxable To Nonresident Shareholders Ohio State Tax Blog State And Local Tax Issues